The Future of eCommerce: How PayPal Encourages Businesses

eCommerce’s future is changing quickly. The need for businesses to embrace creative solutions is growing as the digital world progresses. These solutions help make transactions easier and improve customer experiences. One company leading this change is PayPal. PayPal, which is well-known for its dependable online payment system, assists companies of all sizes in overcoming the difficulties associated with eCommerce. It provides security and creates new growth opportunities.

E-commerce accounted for more than 19% of global retail revenues in 2023. PayPal’s services are helping businesses keep ahead of these trends as they continue to rise. Their tools provide the necessary infrastructure for success in a competitive market.

Reasons Why PayPal Is So Popular

By continuously changing to satisfy the demands of contemporary businesses and consumers, PayPal has emerged as a leader in digital payments. Its capacity to adapt has allowed it to keep a significant market share. PayPal provides unparalleled security and user-friendliness for startups, eCommerce platforms, or companies collaborating with a reliable app development company. It is a popular option for companies all around the world because it also offers cutting-edge features that guarantee seamless and effective transactions. Its global reach and seamless interfaces make it an essential tool for businesses looking to thrive in an increasingly digital marketplace.

As Alex Chriss, PayPal’s President and CEO, stated, “PayPal is on a mission to revolutionize commerce globally, and today we are starting the next chapter. With nearly 400 million consumer accounts and 35 million merchant accounts, PayPal handles transactions for about a quarter of the world’s e-commerce transactions each year. But, more importantly, shoppers trust PayPal to power their payments.”

1. Trusted Brand with Global Reach

PayPal is known for its strong reputation. This reliability is a key reason why many people trust it. PayPal is used by both individuals and businesses for safe, dependable international payment processing. It has an unmatched global reach thanks to its extensive network, which comprises 35 million merchant accounts and almost 400 million consumer accounts. PayPal lets businesses grow internationally without having to deal with the hassles of regional financial systems by facilitating transactions in more than 200 countries and supporting a variety of currencies. For expanding eCommerce enterprises and organizations software development for digital payment solutions, this ease of international trade is a crucial advantage.

2. Ease of Integration for Businesses

Whether you’re a lone proprietor or working with a seasoned app development firm, PayPal offers solutions that make integration into eCommerce platforms easier. Developers may easily integrate PayPal’s payment gateway into websites and mobile apps thanks to its user-friendly APIs and SDKs. By lowering checkout friction, these interfaces enable companies to provide a smooth payment experience. Customers are encouraged to make purchases because of this convenience, which immediately increases sales for online retailers and digital marketplaces.

3. Focus on Security and Fraud Prevention

A key component of PayPal’s success is security. It guarantees that every transaction is protected with features like two-factor authentication and sophisticated encryption. PayPal’s Buyer and Seller Protection programs, which offer redress for disputes or fraudulent behavior, also contribute to an additional degree of confidence. Customers feel secure about their purchases, and businesses gain from lower risk. PayPal’s focus on security makes it a popular choice for companies and their development partners in a world where cyber risks are becoming a bigger worry.

4. Innovative Features for Businesses

What makes PayPal unique is its constant innovation. It offers solutions suited to many company models, from enabling monthly subscriptions to providing “Buy Now, Pay Later” choices. Additionally, companies may use PayPal’s sophisticated analytics to learn more about consumer behavior and enhance their marketing plans. PayPal’s ecosystem gives software developers the freedom to create unique solutions that meet certain business requirements. Its constant efforts to improve its platform guarantee that companies stay competitive in an industry that is always evolving.

5. Customer Trust and Loyalty

PayPal is trusted by customers because of its ease of use and security features. Consumers can pay without disclosing private financial information, which encourages repeat business. Businesses gain from this trust since consumers are more inclined to choose PayPal-accepting retailers. PayPal remains a major player in internet commerce. Its large client base contributes to its growth. The platform offers various tools that enhance user experience.

PayPal is a major player in the eCommerce sector. It offers a platform that combines security and worldwide accessibility. The platform also features cutting-edge functionality. Businesses and app development companies alike find it to be a valued partner because to its smooth integrations and reliable reputation, which opens the door for further expansion in the digital economy.

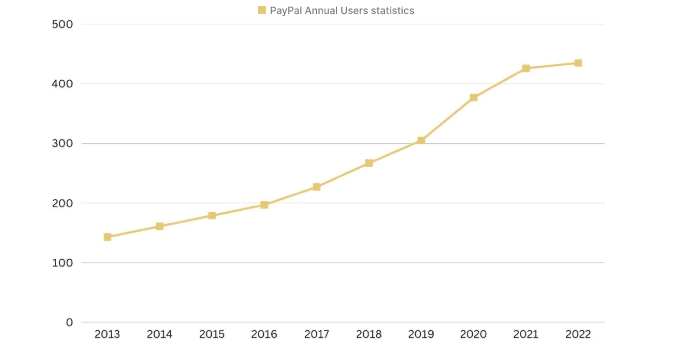

Statistics Of PayPal

PayPal’s remarkable operational and financial expansion demonstrates its supremacy in the digital payment sector. PayPal’s steady revenue growth, enormous transaction volumes, and global user base continue to influence the direction of eCommerce. Let’s examine its milestones in more detail:

Revenue Record: In 2023, PayPal generated $29.2 billion. In comparison to the prior year, this indicated a 7.9% increase. Every year, PayPal has reported a rise in earnings.

Soaring Profits: PayPal’s strong operations and market dominance played a key role in its impressive performance in 2023. The company’s net profit grew by 75%, reaching $4.2 billion.

Huge Transaction Volume: In 2023, PayPal processed 25 billion transactions. These transactions totaled an astounding $1.52 trillion in payments. This covers transactions made via Venmo, its well-known subsidiary.

Payment Volume Growth in 2024: In the first quarter of 2024, PayPal’s total payments increased by 13.9%. The same time frame in 2023 is contrasted with this. The increase shows that PayPal is continuing to make progress.

In the digital economy, these numbers show PayPal’s key role. It helps both consumers and businesses.

Source: Business Of Apps

Looking At The Payment Industry Trends

The payment industry is changing quickly due to new technology and changing consumer preferences. Both consumers and organizations today want payment solutions that are quicker, safer, and more flexible. This shift is driven by decentralized finance and real-time payment systems. These advances are shaping the future of commerce. Software development and resources from an experienced app development company often help support these innovations. Let’s now examine the major advancements that are currently changing payments.

1. BNPL or Buy Now, Pay Later

Buy Now, Pay Later (BNPL) method allows them to spread payments over time. It also helps them avoid paying interest. In eCommerce in particular, this trend is expanding. Popular services include Afterpay and Klarna. When a large online shop partnered with a BNPL supplier, for instance, sales increased by 20%. The mobile app development costs now include incorporating this capability for smooth user experiences as BNPL alternatives increase.

2. CBDCs or Central Bank Digital Currencies

The goal is to create safe digital alternatives to cash. For example, millions of transactions have already been completed under China’s digital yuan pilot. Companies collaborating with a trustworthy app development company are getting ready to integrate CBDC in order to stay competitive in the ever-evolving payment market.

3. Digital Wallets

Both online and in-store shopping now need digital wallets like PayPal, Apple Pay, and Google Pay. The digital wallet component of a US coffee chain’s app was used to place 30% of its orders, increasing customer happiness and checkout time. The seamless integration of these wallets with current systems is ensured by custom software development.

4. Contactless Payments

Contactless payment adoption was sped up by the pandemic. Mobile wallets and NFC-enabled cards became the new standard. One chain of supermarkets, for example, declared that by 2023, 70% of all in-store transactions would be contactless. This trend emphasizes how important it is to design programs that prioritize user comfort and hygiene.

5. Open Banking

Third-party developers can access banks data through open banking to produce customized financial services. A fintech company based in the UK helped users save 15% more each month by providing customized budgeting tools through open banking APIs. Businesses investing in software development are capitalizing on this trend. They enhance user experiences and create innovative solutions.

6. Peer-to-Peer (P2P) Payments’ Development

P2P payment offer features like fast payments and the ability to split expenses. For example, Venmo has bridged the gap between consumer and business use by allowing small business payments. To capitalize on this expanding industry, developers collaborating with an app development company are adding P2P functionality to apps.

7. International Payments

The need for effective international payment solutions has grown as a result of globalization. Wise (previously TransferWise) and other platforms provide quick and inexpensive currency transfers. Wise’s API was incorporated into a freelance marketplace, allowing users to save up to 80% on fees when compared to regular banks. Mobile app development costs for cross-border payment functionality must be taken into account by businesses.

8. Real-Time Payments

Transaction times are changing due to real-time payment systems like Europe’s SEPA and India’s UPI. UPI handled more than 74 billion transactions in India in 2022, which increased the country’s digital penetration in several industries. Businesses who want to offer rapid settlements and implement real-time payment technology must design custom software development.

9. Cryptocurrency Payments

Recently, a chain of upscale hotels started taking Ethereum reservations, drawing in tech-savvy guests. Working with an app development company guarantees the safe and smooth integration of blockchain-based payments as cryptocurrency gains traction.

These patterns demonstrate how the payment sector is still changing as a result of cutting-edge technology that are redefining consumer demands and corporate procedures. Businesses may stay ahead of the curve and maintain the mobile app development costs in line with their strategic objectives by adopting these innovations.

How PayPal Encourages Businesses

PayPal is now a complete platform that helps companies succeed in the cutthroat eCommerce market, having developed from a basic payment gateway. PayPal helps companies reach a wider audience and streamline operations with its cutting-edge features, worldwide accessibility, and integrations designed to satisfy a variety of demands. PayPal helps businesses reach their objectives by providing resources that lower the mobile app development costs or by forming strategic alliances with the top app development company.

1. Streamlined Payment Processing

PayPal’s user-friendly platform makes payment processing easier and removes technological obstacles, enabling businesses to accept payments worldwide. Businesses can make it easier for customers by offering various payment options. This includes bank transfers, PayPal wallets, and credit cards. Integrating PayPal can simplify this process. For example, a retail company worked with a software development team to add PayPal’s API to their eCommerce app. As a result, the number of completed transactions rose by 30%. This happened because the checkout process became smoother and more efficient. The integration made the payment experience quicker and more convenient for customers.

2. Enhanced Business Insights

PayPal gives companies access to sophisticated analytics tools that assist them comprehend the tastes and buying habits of their customers. Businesses may successfully target their audiences and improve their strategies thanks to these information. For example, PayPal and an app development business collaborated to create a unique dashboard for a service that requires a subscription. The company determined its best-selling products using PayPal’s data, then modified its advertising to boost subscriptions by 20%.

3. Global Accessibility

It can be difficult to enter foreign markets, but PayPal makes it easier by supporting a variety of currencies and geographical areas. Companies don’t need complex financial arrangements to take payments from more than 200 countries. As an illustration of how PayPal’s global accessibility is crucial for scaling operations, a firm that used the service to handle international payments was able to lower operational hurdles and boost its overseas sales by 40%.

4. Cost-Effective Solutions for Mobile Commerce

PayPal’s pre-built SDKs, which provide ready-to-use payment connections, lower the mobile app development costs, which can be expensive. This allows companies to concentrate on improving other features of their applications. For example, a small eCommerce company used PayPal’s SDKs to reduce development expenses by 25%, freeing up additional funds for marketing and user experience enhancements.

5. Trust and Brand Recognition

PayPal’s strong security features, like encryption and fraud prevention, have earned the trust of its users. Businesses that use PayPal also benefit from this trust, which boosts client loyalty and confidence. Customers liked utilizing a reliable payment platform, therefore a digital marketplace that accepted PayPal as a payment method saw a 15% increase in recurring business.

PayPal helps businesses of all sizes bridge the gap between innovation and pragmatism by providing customized solutions. It is a desired growth partner because of its tools, which not only improve payment experiences but also lessen the difficulties involved in software and app development.

Conclusion

Platforms like PayPal are shaping the future of eCommerce. They help businesses thrive in the digital world. PayPal makes it easier for companies to reach more people. It offers efficient payment options and global accessibility. Additionally, PayPal provides advanced analytics to support business growth. Its dedication to innovation lowers the mobile app development costs by offering pre-built SDKs and smooth integrations, freeing up companies to concentrate on expansion. PayPal’s solutions help businesses stay competitive in a constantly changing market. This is true whether they work with an app development company or a software development team.

PayPal is a well-known company. It handles a large portion of global eCommerce transactions. The platform has around 400 million customer accounts. Additionally, it has 35 million merchant accounts. As the online retail industry grows, businesses trust PayPal. It provides scalable, reliable, and secure solutions. Digital commerce is still in its infancy, and PayPal continues to be a driving force behind success and innovation.

FAQs

- How does PayPal help businesses reduce mobile app development costs?

PayPal lowers the mobile apps development costs by offering pre-built SDKs and APIs that make it easier to integrate payment gateways into apps. Businesses can save time and money on custom coding while guaranteeing secure payment processing by providing ready-to-use solutions.

- Why is PayPal considered essential for app development companies?

PayPal is frequently used by every app development company to provide safe and dependable payment methods into eCommerce applications. It is a preferred choice for developers wishing to improve payment capabilities for their clients due to its widespread adoption, reliability, and intuitive APIs.

- How does PayPal support software development for eCommerce businesses?

PayPal provides powerful tools for software development teams. These tools help create customized payment solutions for eCommerce platforms. Its flexible APIs ensure smooth integration with existing systems. This makes it easier for businesses to offer secure and flexible payment options. Customers can enjoy a seamless checkout experience.

- Can PayPal help businesses scale globally?

Indeed, PayPal is a fantastic option for companies wishing to go internationally. Transactions in more than 200 countries are supported. Additionally, PayPal handles many different currencies. This makes it simpler for companies to take payments from clients all over the world. Businesses can expedite international transactions by combining PayPal with an app development company.

- What analytics tools does PayPal provide for businesses?

PayPal offers advanced analytics for businesses. These tools help track consumer behavior, transaction trends, and overall sales performance. Software development teams can use these insights to create data-driven features.

- How does PayPal improve the eCommerce experience for businesses and customers?

PayPal offers features like “Buy Now, Pay Later” and one-click checkout. These options make payments easier. Users enjoy a smooth and hassle-free experience. It lowers mobile app development costs for businesses and guarantees safe, quick transactions, which builds client loyalty and trust.